One free app. Everything you need.

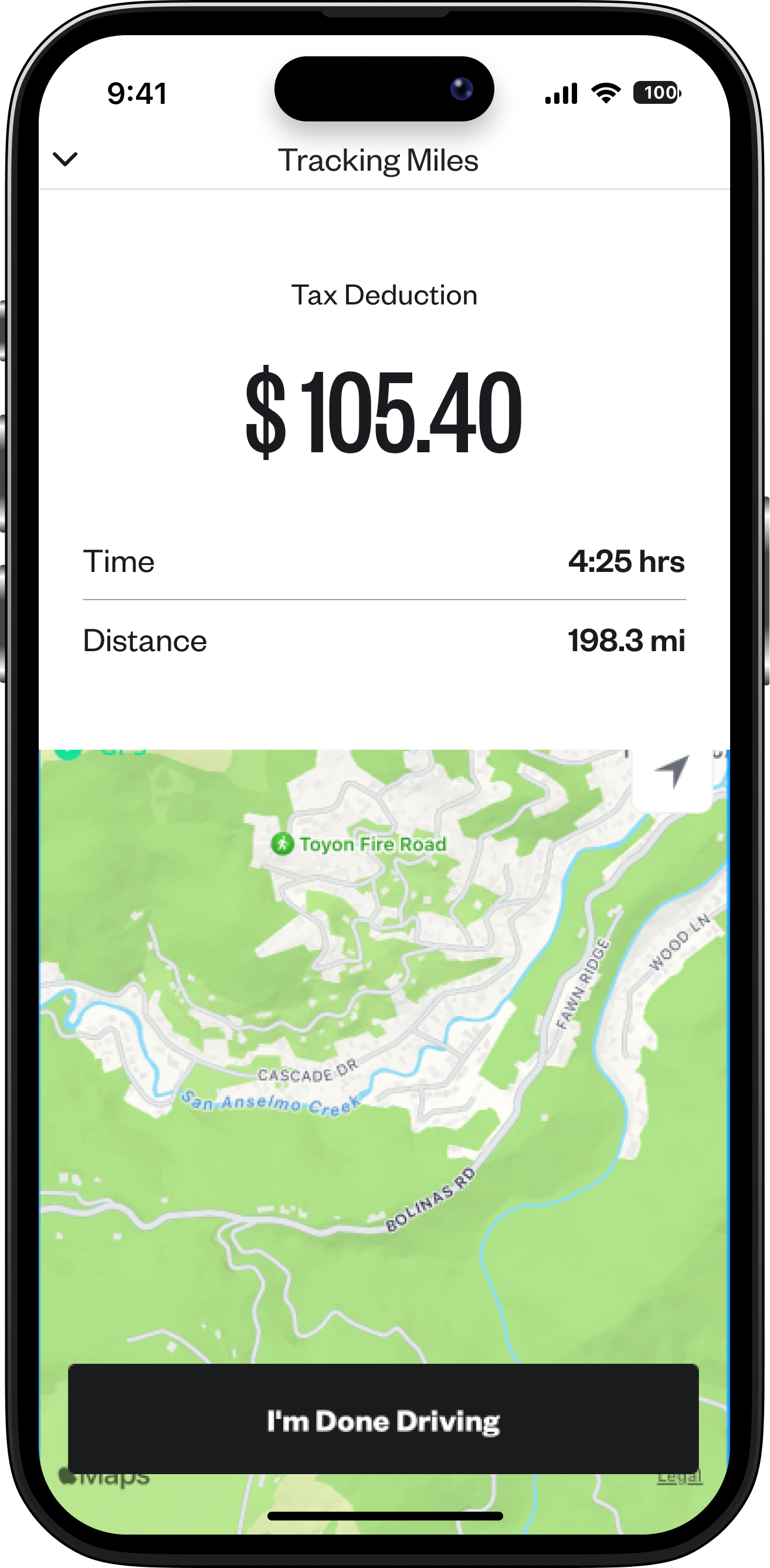

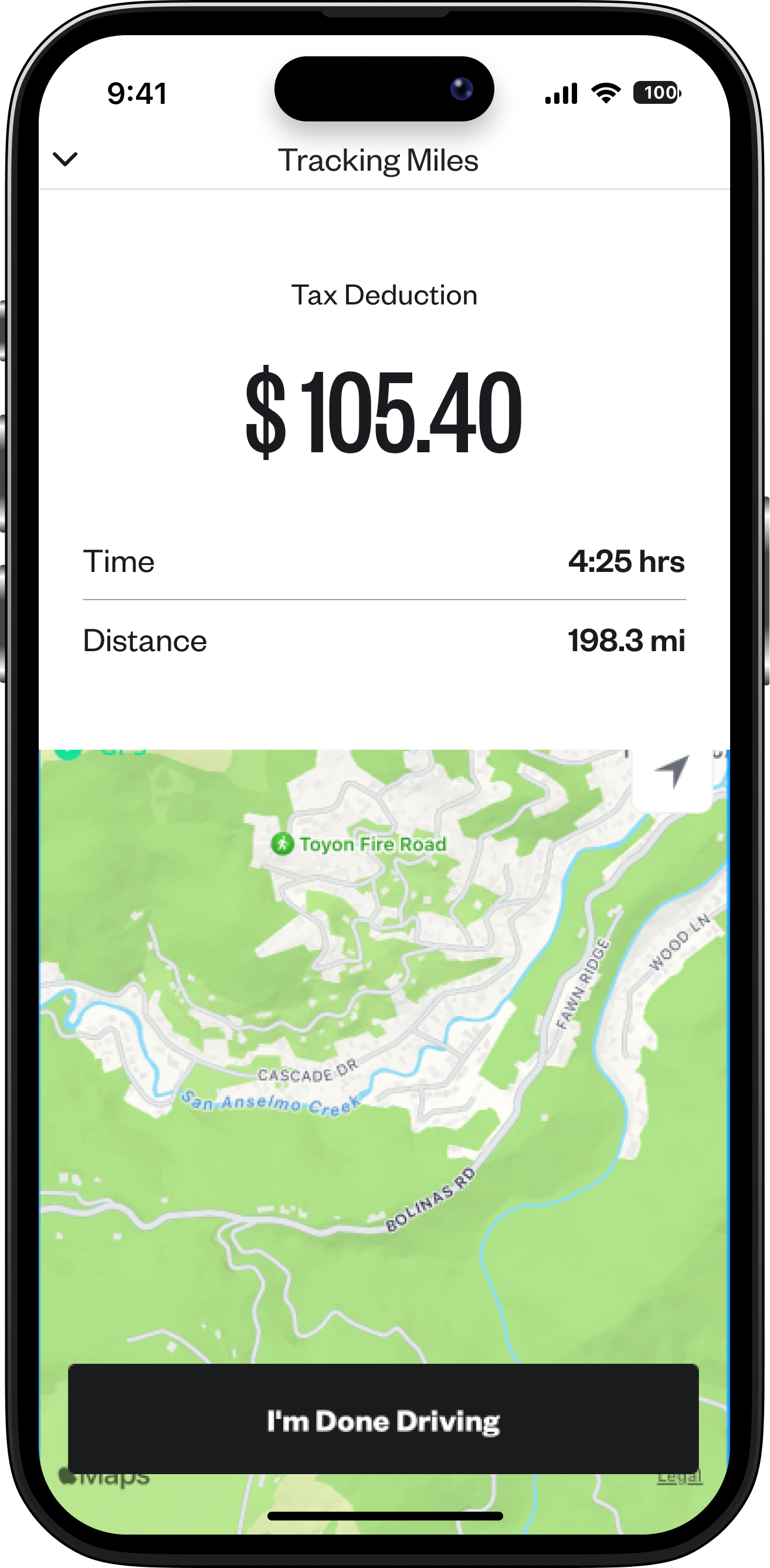

Mileage Tracker

With automatic mileage tracking, every work mile counts towards your tax savings. And you can set reminders so you never forget to log your trips.

Mileage Tracker

With automatic mileage tracking, every work mile counts towards your tax savings. And you can set reminders so you never forget to log your trips.

Don’t settle for less.

Tax season without the stress.

Doing your taxes as an independent worker is overwhelming to say the least. We keep your accounting straight for audit-proof filing that never lets you down.

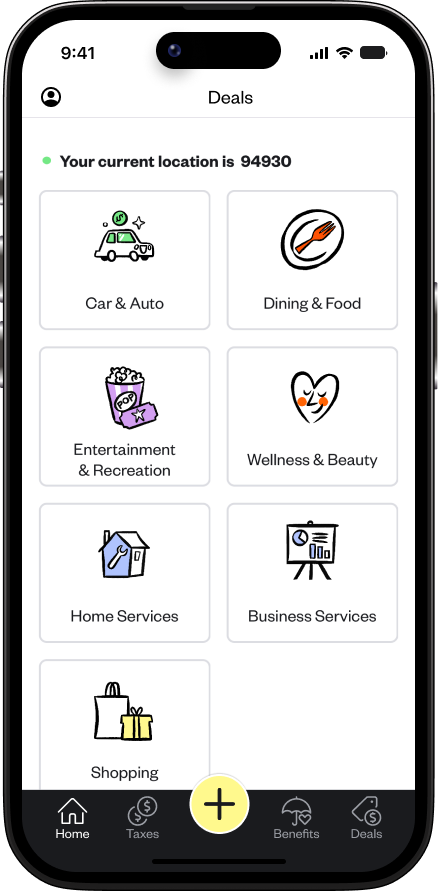

Big savings with little effort.

We help you save any way we can. From automated deductions to daily discounts, our app is designed to help you maximize your savings and minimize your stress.

Support at the touch of a button.

Our in-app guides and customer support team are at the ready to help you handle the complexities of preparing for and filing your taxes with confidence.

We’ve got the As to your Qs.

Do I have to pay for the app?

Stride is free to use! When you use Stride to enroll in insurance, the only cost is the cost of the carrier’s plan — no hidden fees, so you'll always get the lowest price available. And unlike when you enroll through government sites, you'll also get support throughout the enrollment process (and every day after that).

Where can I download the app?

You can find us anywhere you get your apps, like the App and Google Play stores.

How do I connect my bank to the Stride app?

Securely connect your bank account to our app in four simple steps:

Open the app. Tap the profile icon in the upper left-hand corner, then tap “Settings.”

Tap “My Bank Accounts,” then “Add an Account.”

We use a platform called Plaid to securely link your account to our app. Read Plaid’s privacy policy, then tap “Continue.”

Follow Plaid’s instructions in the app to add your account!

Can I file my taxes through Stride?

While you can’t file your taxes directly through our app, we help you have a stress-free tax season. From automatically uncovering tax write-offs based on your logged mileage and expenses to creating IRS-ready expense reports that you can hand directly to an accountant or upload to TurboTax, we simplify every step of the filing process.

Is there someone available to help me with my tax-related questions?

Yes — and not just during tax season! Just like we have dedicated insurance advisors to help you find and enroll in the right coverage, we have tax experts at the ready to answer all the tax and finance questions that come up as an independent.

Independents swear by us.

Reviewed by 40k+ independent workers just like you.